Revolut Premium vs Revolut Metal in Ireland: A Comprehensive Comparison

In today’s fast-paced world, digital banking solutions have become increasingly popular, offering users flexibility, convenience, and innovative features. Revolut stands out as a leading player in this field in Ireland, providing a range of plans tailored to meet different user needs. In Ireland, Revolut Premium and Revolut Metal are two of the most sought-after plans. This comprehensive comparison will delve into the features, benefits, and potential drawbacks of each plan to help you make an informed decision.

Table of Contents

Introduction to Revolut

Revolut is a financial technology company that offers banking services through a mobile app. Since its inception in 2015, Revolut has rapidly expanded, gaining a strong foothold in various countries, including Ireland. The app provides a wide array of services such as currency exchange, budgeting tools, investment opportunities, and even cryptocurrency trading.

Revolut’s plans range from the free Standard plan to the Plus plan and then to the feature-rich Premium, Metal and Ultra plans. Each tier comes with its own set of perks, designed to cater to different user profiles.

Revolut Premium: Features and Benefits

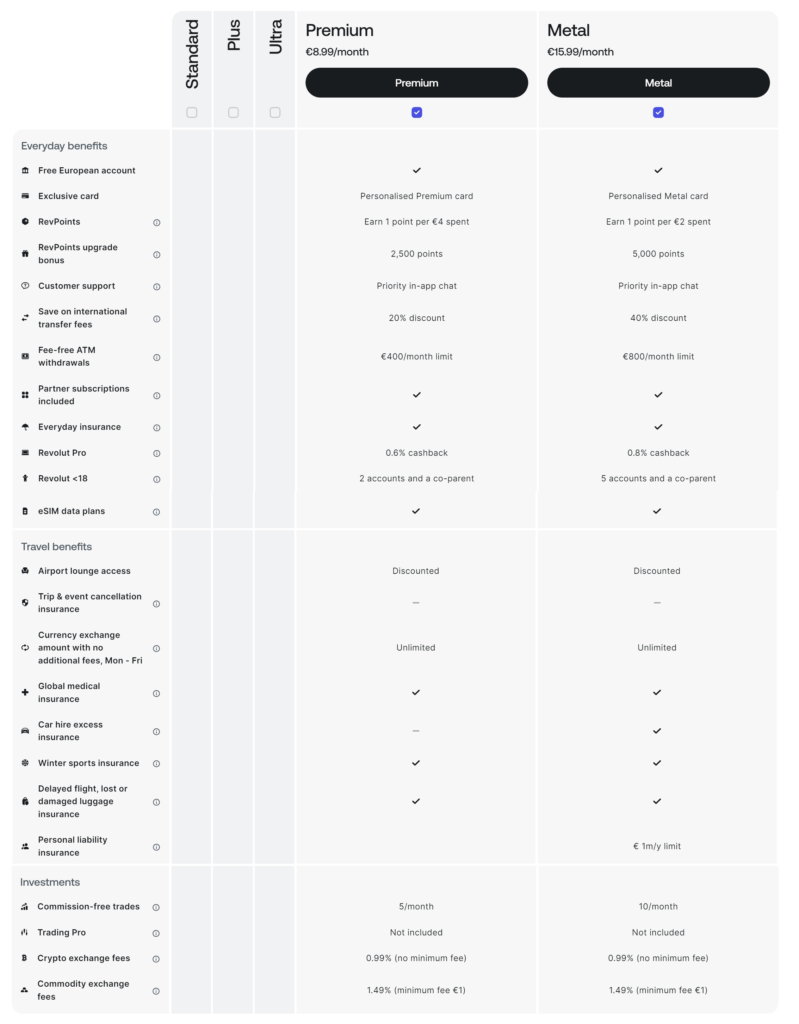

Revolut Premium is designed for users who want more than the basic banking services. Priced at €8.99 per month, it offers a plethora of features that enhance the user experience. Here are some of the key benefits of the Revolut Premium plan:

1. Free ATM Withdrawals

Revolut Premium users can enjoy free ATM withdrawals up to €400 per month. This is particularly beneficial for those who travel frequently and need access to cash without incurring additional fees.

2. Overseas Medical Insurance

Travelers will appreciate the overseas medical insurance included with the Premium plan. This coverage ensures peace of mind when traveling abroad, providing financial protection in case of medical emergencies.

3. Global Express Delivery

Premium users benefit from global express delivery, meaning their Revolut card arrives faster than with the standard delivery option. This can be crucial for new users or those who need a replacement card quickly.

4. LoungeKey Pass Access

While not free, Premium users have the option to purchase LoungeKey Pass access at a discounted rate. This provides entry to over 1,000 airport lounges worldwide, making travel more comfortable.

5. Disposable Virtual Cards

Security-conscious users will find disposable virtual cards particularly useful. These cards can be used for online purchases and then discarded, reducing the risk of fraud.

6. Advanced Security Features

Revolut Premium offers additional security features such as the ability to freeze and unfreeze your card, set spending limits, and receive instant transaction notifications.

7. Priority Customer Support

Premium users have access to priority customer support, ensuring quicker resolution of issues and queries.

8. Cryptocurrency Exchange

Revolut Premium allows users to exchange cryptocurrencies directly within the app. This feature is ideal for those interested in exploring the world of digital currencies.

9. Exclusive Card Designs

Premium users can choose from exclusive card designs, adding a touch of personalization to their banking experience.

10. Rev Points

1 point per every €4 spent. Rev Points can be used to redeem miles against flights or for booking hotels or redeemable at various partners

11. Interest Rates

For Revolut Premium, the interest rates stand at 3% per annum paid out on daily basis(33% CGT withheld during payment)

11. Interest Rates

For Revolut Premium, the interest rates stand at 3% per annum paid out on daily basis(33% CGT withheld during payment)

12. Investments

For Revolut Premium, the commission free trades stands at 5 per month, crypto exchange fees at 0.99% with no minimum fees and commodity exchange fees at 1.49% with min fee of €1

13. Currency exchange limit and International Transfer fees

Metal users can transfer unlimited amount of currency to international bank accounts from Monday to Friday with 20% discount on international transfer fees

14. Free benefits

Nord VPN Standard, Headspace subscription, Sleep cycle premium, Freeletics Coach, Tinder Plus and Picsart Gold

Revolut Metal: Features and Benefits

Revolut Metal represents the pinnacle of Revolut’s offerings. Priced at €15.99 per month, it provides all the benefits of the Premium plan, along with several additional perks. Here’s a closer look at what Revolut Metal brings to the table:

1. Increased Free ATM Withdrawals

Metal users can enjoy free ATM withdrawals up to €800 per month, double the limit offered by the Premium plan. This makes it an excellent choice for those who frequently withdraw cash.

2. Exclusive Metal Card

Revolut Metal users receive a sleek, contactless metal card. This premium card not only looks stylish but is also more durable than traditional plastic cards.

3. Cashback

There is no cashback for spends. It was earlier available, but discontinued at present.

4. Free LoungeKey Pass Access

Unlike the Premium plan, Metal users receive complimentary LoungeKey Pass access. This benefit can save money and enhance the travel experience by providing free entry to airport lounges.

5. Higher Priority Customer Support

Metal users receive the highest level of customer support, ensuring the fastest response times and priority handling of queries and issues.

6. Concierge Service

Revolut Metal includes access to a concierge service, which can assist with a variety of tasks such as booking travel, making restaurant reservations, and arranging special events. This feature is perfect for busy individuals who value convenience and personalized service.

7. Increased Insurance Coverage

Metal users benefit from enhanced insurance coverage, including higher limits on overseas medical insurance and additional types of insurance, such as purchase protection and ticket cancellation insurance.

8. Investment Opportunities

Revolut Metal users have access to more extensive investment opportunities within the app. This includes higher limits for cryptocurrency trading and additional investment products.

9. Exclusive Offers and Discounts

Metal users receive access to exclusive offers and discounts from Revolut’s partner network. These can range from travel discounts to special deals on lifestyle products and services.

10. Rev Points

1 point per every €2 spent. Rev Points can be used to redeem miles against flights or for booking hotels or redeemable at various partners

11. Interest Rates

For Revolut Metal, the interest rates stand at 3.5% per annum paid out on daily basis(33% CGT withheld during payment)

12. Investments

For Revolut Metal, the commission free trades stands at 10 per month, crypto exchange fees at 0.99% with no minimum fees and commodity exchange fees at 1.49% with min fee of €1

13. Currency exchange limit and International Transfer fees

Metal users can transfer unlimited amount of currency to international bank accounts from Monday to Friday with 40% discount on international transfer fees

14. Free benefits

Financial Times Standard Digital Subscription, 1 Wework pass per month, Classpass 10 Credits, Masterclass limited, Chess.com Platinum subscription, Nord VPN Plus, Headspace subscription, Sleep cycle premium, Freeletics Coach, Tinder Gold, The Athletic and Picsart Gold

Comparison: Revolut Premium vs. Revolut Metal

Now that we’ve outlined the features and benefits of each plan, let’s compare them directly across various categories to help you determine which one is right for you.

1. Cost

- Revolut Premium: €8.99 per month

- Revolut Metal: €15.99 per month

While Revolut Metal is nearly twice the cost of the Premium plan, it offers significantly more features and benefits.

2. ATM Withdrawals

- Revolut Premium: Free up to €400 per month

- Revolut Metal: Free up to €800 per month

Metal offers double the free ATM withdrawal limit, which can be crucial for those who rely on cash transactions.

3. Card Design and Materials

- Revolut Premium: Exclusive plastic card designs

- Revolut Metal: Exclusive metal card

The metal card is not only more durable but also adds a premium touch that many users find appealing.

4. Cashback

- Revolut Premium: Not available

- Revolut Metal: Not available

Both plans do not offer any cashback at this point of time

5. Lounge Access

- Revolut Premium: Discounted LoungeKey Pass access

- Revolut Metal: Discounted LoungeKey Pass access

Both plans have the same discounted lounge access

6. Customer Support

- Revolut Premium: Priority support

- Revolut Metal: Highest priority support

Both plans offer priority support, but Metal users receive the fastest response times.

7. Insurance Coverage

- Revolut Premium: Standard overseas medical insurance

- Revolut Metal: Enhanced insurance coverage that includes car hire excess and personal liability insurance worth up to 1 million

Metal users benefit from higher limits and additional types of insurance

8. Investment Opportunities

- Revolut Premium: Access to cryptocurrency exchange

- Revolut Metal: Higher limits and more investment options

Metal users have more extensive investment opportunities within the app.

9. Additional Services

- Revolut Premium: Basic additional services

- Revolut Metal: Concierge service, exclusive offers, and discounts

10. Rev Points

- Revolut Premium: 1 point per every €4 spent

- Revolut Metal: 1 point per every €2 spent

Metal users can earn more points

11. Interest Rates

- Revolut Premium: 3%

- Revolut Metal: 3.5%

Metal offers more interest rates for savings

12. Investments

- Revolut Premium: 5 Free Trades per month

- Revolut Metal: 10 Free Trades per month

Metal offers more free trades

13. Currency exchange fees and International transfer

- Revolut Premium: Unlimited currency exchange with 20% discount on fees

- Revolut Metal: Unlimited currency exchange with 40% discount on fees

Metal users can avail additional 20% discount on international transfer fees

14. Benefits and Free services or subscriptions

- Revolut Premium: NordVPN Standard, Tinder Plus

- Revolut Metal: Financial Times Standard Digital, Tinder Gold, WeWork, Classpass, Chess.com, NordVPN Plus

Metal users can avail of additional subscriptions

Metal’s concierge service and exclusive offers add significant value for users who appreciate personalized assistance and special deals.

Live comparison between Revolut plans – Visit this link https://www.revolut.com/en-IE/our-pricing-plans/

Which Plan is Right for You?

Choosing between Revolut Premium and Revolut Metal depends on your individual needs and preferences. Here are some considerations to help you decide:

Opt for Revolut Premium if:

- You want a feature-rich plan at a lower cost.

- You travel occasionally and would benefit from overseas medical insurance and discounted lounge access.

- You want to earn 3% interest on your savings

- You value enhanced security features and priority customer support.

- You are interested in cryptocurrency trading but do not require the highest limits.

- You are interested in fewer benefits like NordVPN Standard, Tinder Plus only

Opt for Revolut Metal if:

- You frequently travel and need higher free ATM withdrawal limits and free lounge access.

- You want to earn more interest in savings 3.5%

- You appreciate the durability and premium feel of a metal card.

- You require the highest level of customer support and personalized services like a concierge.

- You are looking for enhanced insurance coverage and more extensive investment opportunities.

- You are looking for more benefits or free subscriptions like Financial Times Standard Digital, Tinder Gold, WeWork, Classpass, Chess.com, NordVPN Plus

- You are looking for more discounts in Currency Exchange

Irish Euro Pick

We would pick the Revolut Metal plan as it offers more benefits and more value for money compared to the Premium plan. The additional discount on international transfer fees, FT standard and other subscriptions, additional 0.5% savings interest rate and the unique metal card are worth mentioning

Conclusion

Revolut Premium and Revolut Metal both offer a range of benefits that cater to different user needs. Premium is a great choice for those looking for a robust set of features at a moderate cost, while Metal provides the ultimate Revolut experience with additional perks and services.

By understanding the features and benefits of each plan, you can make an informed decision that best aligns with your lifestyle and financial needs. Whether you choose Premium or Metal, Revolut continues to innovate and provide exceptional digital banking solutions for its users in Ireland and beyond.