Best Personal Loans in Ireland: A Comprehensive Guide for 2024

When it comes to securing a personal loan in Ireland, the options can seem overwhelming. Whether you’re looking to consolidate debt, finance a big purchase, or cover unexpected expenses, finding the right personal loan can make a significant difference. This comprehensive guide will help you navigate the best personal loans in Ireland, offering insights into what to consider, the top lenders, and tips for securing the best rates.

Table of Contents

What is a Personal Loan?

A personal loan is a type of unsecured loan that allows you to borrow a lump sum of money, which you then repay in monthly installments over a set period. Unlike secured loans, personal loans do not require collateral, making them an attractive option for many borrowers. They can be used for various purposes, including home improvements, medical expenses, travel, or debt consolidation.

Factors to Consider When Choosing a Personal Loan

Before diving into the best personal loans available in Ireland, it’s essential to understand the factors you should consider when selecting a loan. Here are some critical aspects to keep in mind:

1. Interest Rates

Interest rates are perhaps the most crucial factor to consider. They determine the total cost of your loan over time. Personal loan interest rates in Ireland can vary significantly between lenders, so it’s essential to shop around and compare rates.

2. Loan Amount and Term

Consider how much money you need to borrow and the period over which you want to repay it. Personal loans typically range from €1,000 to €50,000, with repayment terms from one to seven years. Choose a loan amount and term that fits your budget and financial goals.

3. Fees and Charges

In addition to interest rates, be aware of any fees and charges associated with the loan. These may include origination fees, late payment fees, and early repayment penalties. Understanding these costs upfront can help you avoid surprises later.

4. Repayment Flexibility

Some lenders offer more flexible repayment options than others. Look for features like the ability to make extra payments without penalties or the option to change your payment date.

5. Credit Score Requirements

Your credit score plays a significant role in determining your eligibility for a personal loan and the interest rate you’ll be offered. Lenders typically have minimum credit score requirements, so knowing your score can help you identify suitable loan options.

Top Personal Loans in Ireland for 2024

Now that you understand what to look for in a personal loan, let’s explore some of the best options available in Ireland for 2024. This list includes a mix of traditional banks, credit unions, and online lenders, offering a variety of loan products to meet different needs.

1. Revolut Personal Loans

Revolut is an app-based banking alternative. Revolut is one of the widely used bank accounts in Ireland in 2024. Revolut is registered in Ireland under Central Bank of Ireland and offers an Irish IBAN to its customers with variety of banking offers from time to time.

- Interest Rates: Starting at 6.5% APR

- Loan Amounts: €1,000 to €30,000

- Repayment Terms: 1 to 5 years

- Pros: Flexible repayment options, no early repayment penalties, quick approval process

- Cons: Requires a good credit score

Apply from this link https://www.revolut.com/en-IE/personal-loans/ or directly via App

Revolut Bank, a prominent player in the fintech landscape, has made significant inroads in Ireland, transforming the traditional banking experience with its innovative digital-first approach. Established as a disruptor to conventional banking norms, Revolut offers a comprehensive suite of financial services through its mobile app, catering to both personal and business needs. Irish customers benefit from its seamless money management tools, which include multi-currency accounts, instant international transfers, and advanced budgeting features. The bank’s user-friendly interface, coupled with competitive fees and real-time notifications, appeals particularly to tech-savvy individuals and those seeking greater control over their finances. Revolut’s commitment to financial inclusivity and continuous innovation underscores its growing popularity in Ireland, positioning it as a formidable alternative to traditional banking institutions.

2. AIB Personal Loans

Allied Irish Banks (AIB) is one of the leading banks in Ireland, offering competitive personal loan products. AIB personal loans come with fixed interest rates, making it easier to budget your repayments.

- Interest Rates: Starting at 6.95% APR

- Loan Amounts: €1,000 to €50,000

- Repayment Terms: 1 to 5 years

- Pros: Flexible repayment options, no early repayment penalties, quick approval process

- Cons: Requires a good credit score for the best rates

Apply from this link – https://aib.ie/our-products/loans/personal-loan

AIB has a long history of serving Irish customers with various financial products. Their personal loan process is straightforward and customer-friendly. AIB offers an online application process where applicants can receive approval within 3 hours. They also provide personalized advice to help you understand your repayment capacity and manage your finances effectively.

3. Bank of Ireland Personal Loans

Bank of Ireland offers personal loans with attractive features and competitive rates. They provide quick access to funds and flexible repayment options.

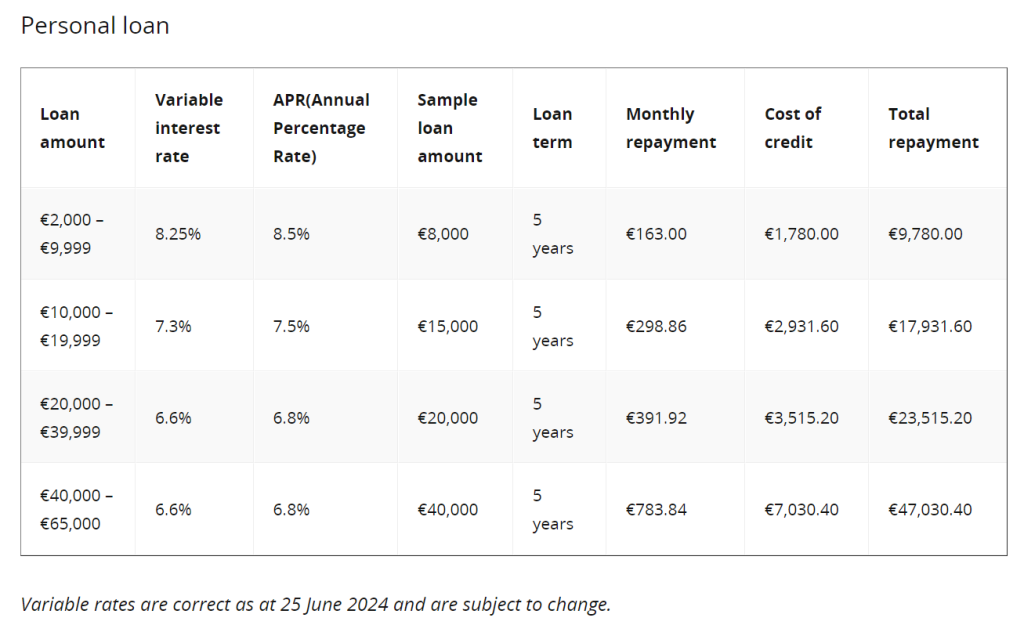

- Interest Rates: Starting at 6.8% to 8.5% Variable APR (See table below)

- Loan Amounts: €1,000 to €65,000

- Repayment Terms: 1 to 5 years

- Pros: Fast approval process, competitive rates, option to defer the first payment for three months

- Cons: May require a higher credit score for larger loan amounts

Apply from this link – https://personalbanking.bankofireland.com/borrow/loans/personal-loan/

Bank of Ireland is renowned for its robust financial services and extensive network. They offer personalized loan solutions, allowing borrowers to defer the first repayment for up to three months, giving some breathing space for financial planning. Their loans can be approved within 24 hours, making them a viable option for urgent financial needs.

4. Credit Union Personal Loans

Credit unions across Ireland offer personal loans with competitive rates and flexible terms. Credit unions are member-owned, meaning they often provide more personalized service and lower rates.

- Interest Rates: Varies by credit union, typically between 6% and 12% APR

- Loan Amounts: €600 to €50,000

- Repayment Terms: 1 to 10 years

- Pros: Personalized service, competitive rates, flexible repayment terms

- Cons: Must be a member of the credit union to apply, rates and terms vary

Apply from this link https://www.creditunion.ie/what-we-offer/loans/personal/

Credit unions are a community-based financial cooperative, offering personalized loan services tailored to their members’ needs. They often provide lower interest rates compared to traditional banks and have flexible terms to accommodate various financial situations. Credit unions emphasize community support, financial education, and personal relationships, making them a great option for borrowers seeking a more personal touch.

5. Avant Money Personal Loans

Avant Money is a popular choice for online personal loans in Ireland. They offer competitive rates and a straightforward online application process.

- Interest Rates: Starting at 6.9% APR

- Loan Amounts: €5,000 to €75,000

- Repayment Terms: 1 to 7 years

- Pros: Competitive rates, easy online application, quick approval

- Cons: Higher minimum loan amount

Apply from this link https://www.avantmoney.ie/personal-loans

Avant Money specializes in online lending, offering a seamless digital experience. Their competitive rates are among the best in the market, and they cater to borrowers with good to excellent credit scores. The application process is fully online, and decisions are often made within 24 hours. Avant Money’s user-friendly platform and efficient service make it an attractive option for tech-savvy borrowers.

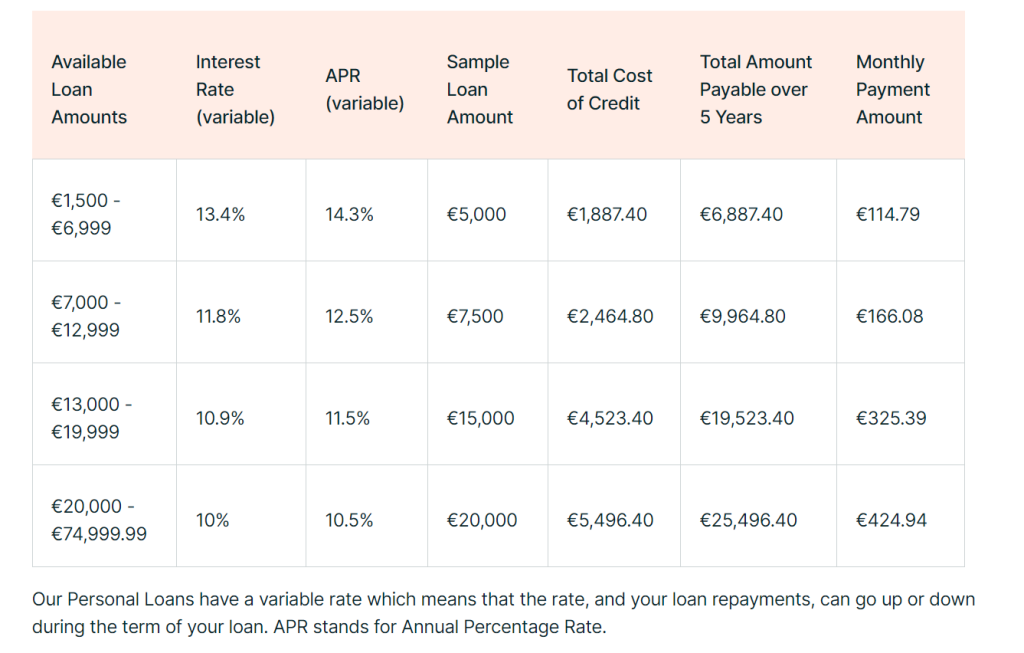

6. Permanent TSB Personal Loans

Permanent TSB offers personal loans with fixed interest rates and flexible repayment options. They provide a seamless online application process and quick access to funds.

- Interest Rates: 10% to 14.3% APR

- Loan Amounts: €1,500 to €75,000

- Repayment Terms: 1 to 5 years

- Pros: Competitive rates, flexible repayment options, no early repayment fees

- Cons: Requires a good credit score for the best rates

Apply from this link https://www.ptsb.ie/borrowing/loans/personal-loan/

Permanent TSB is a well-established bank in Ireland, known for its customer-centric approach. They offer personal loans with flexible terms and competitive rates, ensuring borrowers can find a solution that fits their needs. Their online application is straightforward, and funds can be disbursed quickly upon approval. Permanent TSB also provides financial advice to help customers make informed borrowing decisions.

Case Studies: Real-Life Scenarios

To give you a clearer picture of how these personal loans can be beneficial, here are a few hypothetical case studies:

Case Study 1: Home Renovation

Sarah and John, a couple from Dublin, wanted to renovate their home but didn’t have enough savings to cover the costs. They decided to apply for a personal loan of €20,000 from Bank of Ireland. With an interest rate of 6.8% APR and a repayment term of 5 years, their monthly repayments were manageable, allowing them to complete their renovation without financial stress.

Case Study 2: Debt Consolidation

Michael, a young professional in Cork, had accumulated debt from various credit cards with high-interest rates. He decided to consolidate his debt by taking out a personal loan of €15,000 from AIB. With an interest rate of 6.95% APR, he was able to reduce his monthly payments and pay off his debt more efficiently.

Case Study 3: Medical Expenses

Emma needed €10,000 for an unexpected medical procedure. She applied for a personal loan from Revolut Bank. The application process was quick, and she received the funds within a day. With a fixed interest rate of 6.3% APR, she was able to repay the loan over 3 years without any financial burden.

FAQs about Personal Loans in Ireland

- What is a personal loan?

- A personal loan is an unsecured loan provided by a bank, credit union, or other financial institution that can be used for various purposes such as home improvements, debt consolidation, medical expenses, or other personal needs.

- How much can I borrow with a personal loan in Ireland?

- The amount you can borrow varies by lender, but typically ranges from €1,000 to €50,000, depending on your creditworthiness and the lender’s policies.

- What are the typical interest rates for personal loans in Ireland?

- Interest rates for personal loans in Ireland can vary widely depending on the lender, your credit score, and other factors. They usually range from about 6.5% to 16% APR.

- How long do I have to repay a personal loan?

- Repayment terms for personal loans generally range from 1 to 7 years. The specific term will depend on the loan amount, your preferences, and the lender’s policies.

- What is the difference between a fixed and variable interest rate?

- A fixed interest rate remains the same throughout the loan term, providing predictable monthly payments. A variable interest rate can fluctuate over time based on changes in market interest rates, which can affect your monthly payments.

- Can I pay off my personal loan early?

- Most lenders in Ireland allow early repayment of personal loans, but some may charge an early repayment fee. It’s important to check the terms and conditions of your loan agreement.

- What are the eligibility criteria for a personal loan in Ireland?

- Eligibility criteria typically include being over 18 years old, having a stable income, and being a resident of Ireland. Lenders will also consider your credit history and ability to repay the loan.

- How long does it take to get approved for a personal loan?

- Approval times can vary by lender. Some lenders offer quick online applications with approvals in minutes, while others may take a few days to process your application.

- Do I need a good credit score to get a personal loan in Ireland?

- A good credit score can improve your chances of getting approved and securing a lower interest rate. However, some lenders offer loans to individuals with less-than-perfect credit, though the interest rates may be higher.

- What documents do I need to apply for a personal loan?

- Required documents typically include proof of identity (passport or driver’s license), proof of address (utility bills or bank statements), proof of income (pay slips or tax returns), and bank account details. Specific requirements may vary by lender.

Irish Euro Pick

Revolut

Reason : Fastest approval in-app and the best interest rates as of July 2024

Current Trends in the Personal Loan Market in Ireland

As we move through 2024, several trends are shaping the personal loan market in Ireland:

1. Increasing Use of Online Lenders: More borrowers are turning to online lenders for their personal loan needs due to the convenience and speed of the application process.

2. Competitive Interest Rates: With increased competition among lenders, interest rates for personal loans are becoming more competitive, benefiting borrowers.

3. Flexible Repayment Options: Lenders are offering more flexible repayment terms to attract customers, including options to defer payments or make extra payments without penalties.

4. Focus on Financial Wellness: Many lenders are emphasizing financial education and wellness, offering resources and tools to help borrowers manage their finances better.

5. Use of Technology: Advances in technology are streamlining the loan application process, with more lenders using artificial intelligence and machine learning to assess creditworthiness and approve loans faster.

Best Personal Loans in Ireland in a Nutshell

| Lender | Pros | Cons |

|---|---|---|

| AIB Personal Loans Ireland | – Flexible repayment options – Quick approval process – No early repayment penalties | – Requires a good credit score for the best rates |

| Bank of Ireland Personal Loans Ireland | – Fast approval process – Competitive rates – Option to defer the first payment for three months | – May require a higher credit score for larger loan amounts |

| Revolut Personal Loans Ireland | – Competitive rates – Quick and easy online application / application via app – No early repayment fees | – May take more time in exceptional cases |

| Credit Union Personal Loans Ireland | – Personalized service – Competitive rates – Flexible repayment terms | – Must be a member of the credit union to apply – Rates and terms vary |

| Avant Money Personal Loans Ireland | – Competitive rates – Easy online application – Quick approval | – Higher minimum loan amount |

| Permanent TSB Personal Loans Ireland | – Competitive rates – Flexible repayment options – No early repayment fees | – Requires a good credit score for the best rates |

Conclusion

Finding the best personal loan in Ireland requires careful consideration of various factors, including interest rates, loan amounts, repayment terms, and fees. By understanding your financial needs and comparing loan options from different lenders, you can secure a personal loan that fits your budget and helps you achieve your financial goals.

Remember to check your credit score, gather the necessary documentation, and shop around for the best rates. With the right approach, you can find a personal loan that provides the funds you need at a cost you can afford.

In 2024, lenders like AIB, Bank of Ireland, Revolut, Credit unions, Avant Money, and Permanent TSB offer some of the best personal loan options in Ireland. Each lender has its strengths, so consider your unique needs and preferences when choosing a loan.

By following the tips and advice in this guide, you’ll be well-equipped to navigate the personal loan market in Ireland and secure the best loan for your situation.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!